Introduction

Since its first implementation in the 1970s, EDI helped customs brokers transform the way international trade documentation is processed. Today, this computer-to-computer exchange system significantly reduces administrative costs while improving accuracy in customs declarations and compliance.

We understand that implementing EDI with customs clearance systems can seem complex, but its benefits are clear – from automated B2B processes to faster clearance times and reduced border delays. Furthermore, by choosing a cloud-based EDI service, customs brokers can eliminate the need for substantial upfront investments in software and hardware, making it an accessible solution for businesses of all sizes.

EDI for Customs Brokers

For customs brokers, EDI enables “lights out processing” – a fully integrated system where transactions flow automatically from beginning to end without manual intervention. This EDI automation accelerates customs clearance by transmitting data to Customs and Border Protection (CBP) systems electronically, resulting in faster transaction processing and improved sharing of electronic data between CBP and other government agencies.

Key EDI Standards for International Trade (X12, EDIFACT)

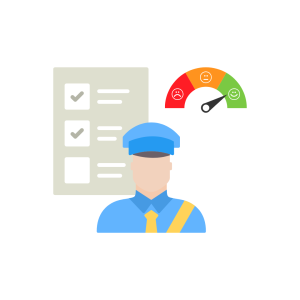

Two primary EDI standards dominate international trade:

ANSI X12: Developed by the American National Standards Institute, X12 is predominantly used in North America. It employs a hierarchical structure of segments with the top-level segment (ISA) identifying the sender and receiver. X12 transaction sets are identified by three-digit numeric codes (e.g., 850 for purchase orders).

EDIFACT: Created by the United Nations, EDIFACT (Electronic Data Interchange For Administration, Commerce, and Transport) is the preferred standard in Europe, Asia, and other international markets. Unlike X12, EDIFACT uses a flat structure with all segments at the same level and six-character alphanumeric codes for message identification.

Common EDI Transaction Sets in Customs Processing

Transaction sets represent specific business documents exchanged between partners. Common sets in customs include:

- Customs Declaration (CUSDEC): Submits detailed declaration of imported/exported goods

- Customs Response (CUSRES): Acknowledgment from customs authorities

- Cargo Report (CARGO): Provides detailed cargo information

- Invoice (INVOIC): Sends commercial invoice details

Additionally, customs brokers utilize transaction sets like 810 (Invoice), 850 (Purchase Order), and 856 (Ship Notice).

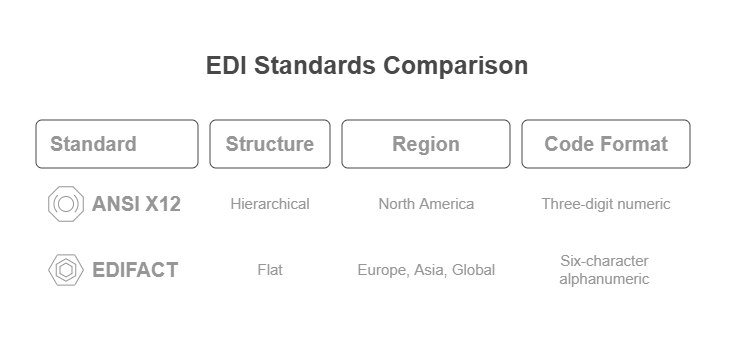

Planning Your Customs Broker EDI Implementation

Successful EDI implementation for customs brokers begins with methodical planning and thorough preparation. Before diving into technical aspects, seven foundational steps ensure your customs EDI project delivers maximum value.

- Assessing Your Current Workflow and Pain Points

First, conduct a comprehensive analysis of your existing business processes. Identify areas suffering from human error, technological gaps, or high operational costs. This assessment helps pinpoint where EDI implementation will deliver the greatest efficiency gains and cost savings. Document specific requirements to communicate your needs effectively to potential EDI providers, ensuring solutions align precisely with your business objectives.

- Selecting the Right EDI Solution Provider

When evaluating EDI providers, focus on those who understand your specific business requirements and possess adequate technical installation knowledge. The provider should offer comprehensive support, training, and ongoing technical assistance. Moreover, verify they support necessary EDI standards and communication protocols such as AS2, SFTP, or VAN. Look for capabilities to transform and orchestrate data regardless of format.

- Creating a Realistic Implementation Timeline and Budget

EDI implementation often takes longer than expected. According to one implementation experience, each EDI message type required approximately one month of three-way meetings between the team, trading partners, and the EDI provider. Therefore, develop a realistic timeline that includes testing, parallel processing periods, and staff training. Additionally, budget for potential long-term operational costs beyond initial implementation expenses.

- Setting Up Secure Communication Channels (AS2, SFTP, VAN)

The foundation of any customs EDI implementation begins with establishing secure communication channels. Most customs brokers use one of three primary methods:

- AS2 (Applicability Statement 2)– This protocol uses HTTPS and S/MIME encryption, making it highly secure for EDI transactions. Initially adopted by major retailers, AS2 has become increasingly popular for customs filings because it encrypts both authentication credentials and the transferred data.

- SFTP (Secure File Transfer Protocol)– Built on SSH encryption, SFTP offers robust protection against cyber threats including man-in-the-middle attacks. It’s particularly useful for organizations needing to meet regulatory requirements.

- VAN (Value-Added Network)– This third-party service supports multiple communication protocols but comes with subscription costs. However, VANs offer wider interoperability across different systems.

- Mapping Data Fields Between Your System and Customs EDI

EDI mapping transforms data between different formats, allowing systems to “speak the same language.” This critical process involves creating interface files that translate your internal data into standardized custom formats.

When developing mapping specifications, include:

- Source and target field identifications

- Data element descriptions with clear segment references

- Standardized naming conventions for file organization

For customs filings specifically, the mapping must accommodate all required fields used by customs authorities while connecting properly to your internal systems. Most brokers implement unit and integration testing before validating data through parallel processing periods.

- Testing and Validation Procedures for Customs EDI

Before transmitting data to customs systems, rigorous EDI testing is essential. CBP explicitly requires testing to “ensure all programming is correct and that systems can send data to and receive data from CBP”.

Effective validation includes:

- Checking for mandatory elements, proper data types, and field lengths

- Validating against specific customs requirements

- Conducting end-to-end testing through various business scenarios

Most customs brokers employ a phased testing approach with unit testing, integration testing, and parallel processing for two weeks before full implementation.

- Training Your Staff in New EDI Workflows

Finally, comprehensive training ensures your team can effectively operate new EDI systems. Different stakeholders require specific training:

IT personnel need technical training on EDI standards, data mapping, and troubleshooting techniques. Meanwhile, operations staff must understand how to interpret EDI documents and handle exceptions.

Well-trained employees reduce errors while increasing accuracy, as EDI eliminates manual data entry prone to mistakes. Remember that training should be tailored to your specific business requirements and processes for maximum effectiveness.

Conclusion

EDI technology has fundamentally changed how customs brokers handle international trade documentation. Through automated data exchange, standardized formats, and secure communication channels, businesses now process customs declarations faster and more accurately than ever before.

Successful EDI implementation requires careful planning, starting with a thorough workflow assessment and building a skilled implementation team. Technical integration demands precise configuration of communication protocols, data mapping, and rigorous testing procedures. Companies like Commport EDI Solutions help customs brokers streamline these complex processes while ensuring compliance with international trade regulations.

ROI tracking shows significant benefits – customs brokers typically save $2.50 for every $1.00 invested in automation. These savings come from reduced labor costs, fewer compliance penalties, and faster processing times. Regular monitoring and optimization of EDI systems ensure continued efficiency gains and maintain high service standards.

The future of customs brokerage lies in automated, efficient EDI systems. As trade volumes grow and regulations become more complex, EDI will remain essential for businesses aiming to stay competitive in international commerce. Therefore, investing time and resources in proper EDI implementation today will yield substantial returns through improved accuracy, speed, and customer satisfaction tomorrow.

Commport EDI Solutions

Need Help? Download: Commport's EDI Buyers Guide

Unlock the full potential of your supply chain with our comprehensive EDI Buyer's Guide — your first step towards seamless, efficient, and error-free transactions

Frequently Asked Questions

EDI (Electronic Data Interchange) is a system that enables automated exchange of standardized business documents between trading partners. For customs brokers, it streamlines customs clearance processes, reduces manual data entry, improves accuracy, and speeds up transaction processing.

EDI standardizes and automates the exchange of business documents in international trade. It significantly reduces paperwork, minimizes errors, accelerates customs clearance times, and improves communication between trading partners and customs authorities.

The two primary EDI standards for international trade are ANSI X12 (used mainly in North America) and EDIFACT (preferred in Europe, Asia, and other international markets). These standards define the format and structure of electronic documents exchanged in customs processing.

EDI implementation timelines can vary, but it often takes longer than expected. On average, each EDI message type may require approximately one month of collaborative work between the implementation team, trading partners, and the EDI provider.

The primary cost savings from EDI implementation in customs processing come from reduced labor costs due to automation, fewer compliance-related penalties, decreased detention and storage charges through timely filings, and improved cash flow from faster payment processing. Studies suggest that automation can provide approximately $2.50 in benefits for every $1.00 invested.