Introduction

Imagine a world where invoices fly through cyberspace faster than you can say “accounts payable,” and where human error is as rare as a unicorn sighting. That’s the magic of EDI billing, folks!

It’s revolutionizing how companies handle transactions, cutting costs faster than a budget barber, and making accountants’ lives easier than a Sunday morning.

So buckle up, because we’re about to dive into the thrilling world of EDI billing – where efficiency meets excitement, and where the only thing getting lost in translation is your old-school filing cabinet.

"Processing an order manually can cost $38, compared to just $1.35 with EDI reducing operational costs by up to 35% or more"

What is EDI Billing?

EDI billing refers to the electronic exchange of billing documents between trading partners using standardized formats. This process allows for the seamless transmission of invoices, purchase orders, and other relevant documents without the need for paper. By utilizing formats such as ANSI X12 or EDIFACT, businesses ensure that the information exchanged is consistent and easily interpretable by all parties involved.

The integration of EDI billing systems into business operations marks a significant shift towards automation and efficiency. With the advent of EDI, businesses can automate their billing processes, minimize human intervention, and ensure that transactions are processed with greater accuracy and speed. As a result, companies can allocate their resources more effectively, focusing on strategic tasks that drive growth rather than being bogged down by administrative burdens.

Key elements of EDI billing include:

- Standardized invoice formats (e.g., ANSI X12, EDIFACT)

- Automated processing without human intervention

- Secure data transmission between business partners

- Integration with ERP, TMS, and other enterprise systems

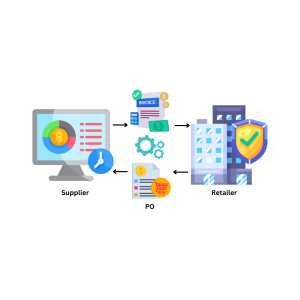

The Role of Trading Partners

In the context of EDI billing, trading partners are the entities involved in business transactions. These could range from suppliers and manufacturers to retailers and service providers. The effectiveness of EDI billing relies heavily on the collaboration and technological compatibility between these partners, making it crucial for businesses to establish strong relationships and clear communication protocols.

Key EDI Formats and Standards

Understanding the different EDI formats is crucial for successful implementation:

- ANSI X12: Predominantly used in North America, this format covers various transaction types, including invoices and purchase orders.

- EDIFACT: An international standard used for electronic data exchange, particularly in Europe.

- TRADACOMS: Commonly utilized in the UK retail sector, this format focuses on specific retail transactions.

Comparison: EDI Billing vs. Traditional Billing Methods

Aspect | EDI Billing | Traditional Billing Methods |

|---|---|---|

Speed and Efficiency | Transactions are processed in real time, eliminating delays associated with printing, mailing, and manual processing. This results in faster billing cycles and quicker access to funds | Paper invoices can take days or weeks to be delivered, processed, and paid, slowing down cash flow |

| Accuracy | Automated processes reduce human errors such as typos or misplaced information. Data is exchanged electronically in standardized formats, ensuring consistency | Manual data entry increases the risk of errors, which can lead to costly disputes or delays |

| Cost Savings | Eliminates expenses related to paper, printing, postage, and storage. Labor costs are reduced due to automation | Requires ongoing costs for physical materials and additional staff for manual processing |

| Information Retrieval | Digital records are easily searchable and stored securely in databases, simplifying audits and reducing clutter | Paper invoices require physical storage space and can be difficult to retrieve when needed |

| Environmental Impact | Paperless transactions reduce waste and contribute to sustainability efforts | Relies heavily on paper, contributing to environmental degradation |

| Business Relationships | Streamlined transactions improve collaboration with trading partners by fostering trust and reliability | Inefficiencies can strain relationships due to delays or errors in billing processes |

Challenges Businesses Face Without EDI Billing System

Without EDI billing, businesses encounter several inefficiencies that impact financial operations. These include:

- Manual Data Entry Errors – Hand-keying invoices leads to inaccuracies, causing payment delays and disputes.

- Slow Processing Times – Paper-based invoices take longer to generate, send, and process, delaying cash flow.

- High Administrative Costs – Printing, mailing, and processing invoices incur additional costs and require extensive labor.

- Compliance Risks – Inconsistent or incorrect invoice formats may lead to regulatory non-compliance and penalties.

- Limited Visibility – Without real-time tracking, businesses struggle to monitor invoice statuses, leading to cash flow unpredictability.

How EDI Billing Works

The EDI Billing Process

The EDI billing process involves several key steps:

- Preparation of Billing Data: The seller compiles necessary billing information, including customer details, invoice numbers, transaction dates, and payment terms.

- Data Formatting: This information is then converted into an EDI format, ensuring compatibility between the sender and receiver.

- Transmission: The formatted invoice is securely transmitted to the buyer using established communication protocols such as AS2 or SFTP.

- Receipt and Acknowledgment: Upon receiving the invoice, the buyer’s system sends an acknowledgment back to the seller, confirming receipt and processing status.

- Processing the Invoice: The buyer validates the data, matches it with purchase orders, and enters it into their accounting system.

- Payment and Remittance: Finally, payment is processed according to agreed-upon terms, often facilitated through electronic funds transfer (EFT).

Implementing EDI Billing

1. Assessing Business Needs

Before implementing EDI billing, businesses must evaluate their specific requirements. This includes understanding transaction volumes, system integration needs, and the types of documents that will be exchanged.

2. Selecting an EDI Provider

Choosing the right EDI provider is crucial for successful implementation. Businesses should consider factors such as the provider’s experience, support services, and the scalability of their solutions. A reliable provider can guide organizations through the integration process and offer ongoing support.

3. Integration with Existing Systems

Integrating EDI billing with current business systems, such as ERP or accounting software, is essential for seamless operations. This integration ensures that data flows smoothly between systems, reducing the need for manual intervention and improving overall efficiency.

4. Training and Support

Once the EDI system is in place, training staff on its use is vital. Employees should be familiar with the new processes and understand how to troubleshoot common issues. Ongoing support from the EDI provider can help address any challenges that arise.

How Does EDI Billing Contribute to Cost Savings for Businesses

EDI billing contributes to cost savings for businesses in several impactful ways:

- Elimination of Paper-Based Costs: EDI replaces the need for paper, printing, postage, and storage, reducing operational costs by up to 35% or more. For example, processing an order manually can cost $38, compared to just $1.35 with EDI.

- Labor Cost Reduction: By automating tasks like data entry and invoice processing, EDI minimizes the need for manual labor. This allows businesses to reallocate staff to higher-value activities, further lowering administrative expenses

- Error Reduction Savings: Manual billing processes are prone to errors that can lead to costly disputes and delays. EDI significantly reduces these errors, saving businesses from penalties, credits, or the expense of correcting mistakes.

- Faster Payment Cycles: EDI accelerates the billing and payment process, improving cash flow and reducing the financial strain caused by delayed payments. This faster cycle can also unlock early payment discounts from trading partners.

- Scalability Without Increased Costs: EDI systems handle high transaction volumes without requiring proportional increases in resources or costs, making it a cost-effective solution for growing businesses.

- Inventory and Supply Chain Efficiency: Real-time data exchange through EDI improves inventory management and reduces costs associated with overstocking or stockouts. This efficiency also cuts down on order processing times and delivery delays

Importance of EDI Billing in Different Industries

1. Healthcare Industry

In the healthcare sector, EDI billing plays a crucial role in managing patient information and insurance claims. The complexity of medical billing, coupled with the need for accuracy and compliance with regulations, makes EDI an invaluable tool. By automating billing processes, healthcare providers can reduce administrative burdens and improve cash flow.

2. Retail Sector

For retailers, EDI billing streamlines the exchange of invoices and purchase orders with suppliers. This efficiency is particularly important in a fast-paced retail environment where timely inventory management is critical. EDI enables retailers to maintain accurate records and ensure prompt payments to suppliers.

3. Manufacturing

Manufacturers benefit from EDI billing by enhancing supply chain efficiency. The ability to quickly exchange billing information with suppliers and customers allows for better inventory management and production planning. EDI also supports Just-In-Time (JIT) manufacturing practices, ensuring that materials arrive precisely when needed.

Benefits of EDI Billing

1. Enhanced Efficiency

One of the most significant advantages of EDI billing is its ability to automate manual processes. By reducing the reliance on paper documentation, businesses can process invoices faster, allowing them to focus on core operations.

2. Improved Accuracy

Manual data entry is often fraught with errors. EDI minimizes these risks by automating data input, ensuring that information is entered accurately and consistently. This reduction in errors leads to fewer disputes and delays in payment processing.

3. Cost Savings

Transitioning to EDI billing can lead to substantial cost reductions. By eliminating the need for paper, printing, and postage, businesses can save on operational expenses. Moreover, the efficiency of EDI processes can result in quicker payment cycles, improving cash flow.

4. Strengthened Business Relationships

Streamlined billing processes foster better relationships between trading partners. EDI billing simplifies transactions, making it easier for partners to collaborate and communicate effectively. This improved interaction can lead to increased trust and long-term partnerships.

Conclusion

EDI billing represents a significant advancement in the way businesses manage their billing processes. By automating transactions and reducing reliance on paper, companies can improve efficiency, accuracy, and cost-effectiveness. While challenges may arise during implementation, the long-term benefits of EDI billing make it a worthwhile investment for organizations across various industries.

Commport EDI Solutions

Need Help? Download: Commport's EDI Buyers Guide

Unlock the full potential of your supply chain with our comprehensive EDI Buyer's Guide — your first step towards seamless, efficient, and error-free transactions

Frequently Asked Questions

EDI billing automates invoice exchanges using standardized electronic formats, eliminating manual errors and delays, while traditional invoicing relies on paper or PDFs.

Yes, EDI billing uses encrypted data transmission and compliance protocols to ensure secure transactions between trading partners.

EDI billing solutions seamlessly integrate with ERP platforms to automate invoice generation, processing, and reconciliation.

Industries such as retail, healthcare, logistics, manufacturing, and finance benefit significantly from EDI billing.

Businesses can start by assessing their invoicing needs, selecting a reliable EDI provider, defining billing standards, and integrating the system with existing platforms.