The EDI 828 is a type of electronic data interchange transaction set that is used for transmitting debit authorization information from paying entities to their financial institutions. It allows businesses to communicate and manage authorized debits, including both electronic (ACH) and paper-based transactions, streamlining the process of verifying and processing debit payments.

The EDI 828 enables companies to add new authorizations, cancel existing ones, and manage both one-time and recurring debit transactions. By providing detailed information about pre-authorized debits

This electronic document complies with the ANSI X12 EDI specification.

All EDI documents are securely encrypted in transit, allowing trading partners to send sensitive data safely. By communicating the acceptance, rejection, and processing status of EDI transactions, it plays a critical role in ensuring efficient, accurate, and seamless data exchange between trading partners.

Enhanced Accuracy

The EDI 828 reduces errors in debit processing by providing clear, pre-authorized transaction details.

Improved Efficiency

Automates the authorization process, saving time and resources.

Better Cash Flow Management

Allows businesses to have a clear overview of upcoming debits.

Increased Security

Helps prevent unauthorized debits by establishing a pre-authorization system.

The EDI 828 transaction set is used to provide a standardized format for transmitting debit authorization information. Here’s how it works:

EDI 828 is not limited to a single type of debit transaction. It can also be used for:

The EDI 828 transaction set is composed of several key segments:

ST – Transaction Set Header: Marks the beginning of the transaction set.

BAU – Beginning Segment for Debit Authorization: Contains critical information about the payer’s financial institution and account.

N1-N4 – Name and Address: Optional segments for additional party information.

DAD – Debit Authorization Detail: The core of the transaction set, providing specific details about each debit authorization.

CTT – Transaction Totals: Includes a count of DAD segments for verification purposes.

SE – Transaction Set Trailer: Marks the end of the transaction set.

EDI 828, also known as the Debit Authorization transaction set, is a standardized electronic format used in Electronic Data Interchange (EDI) for transmitting debit authorization information from paying entities to their financial institutions. It allows businesses to communicate and manage authorized debits, including both electronic (ACH) and paper-based transactions, streamlining the process of verifying and processing debit payments.

An EDI 828 transaction usually includes:

EDI 828 is specifically designed for debit authorizations, setting it apart from other financial EDI transactions. While transactions like EDI 820 (Payment Order/Remittance Advice) focus on the actual payment process, EDI 828 is used to pre-authorize future debits. This proactive approach allows for better financial planning and increased security in transaction processing.

No, EDI 828 is primarily designed for bank account debits, particularly those processed through the Automated Clearing House (ACH) network. For credit card authorizations, businesses typically use different systems and protocols specific to card payment networks.

EDI 828 is particularly useful for managing recurring payments. You can use it to set up authorizations for regular debits, specifying details such as frequency, amount, and duration. This eliminates the need to obtain separate authorizations for each recurring transaction, streamlining the process for both the business and the customer.

Experience the effortless power of Commport’s Integrated EDI solution today! Say goodbye to complicated and costly software installations, and forget about the need to be an EDI expert or create your own mappings. Our seamless solution adapts effortlessly to your business’s growth, making adding new customers a breeze.

With fast and reliable translation, you can rest assured that your EDI processes are in safe hands, allowing you to focus on what truly matters – your business.

Take the next step towards efficiency and success with Commport.

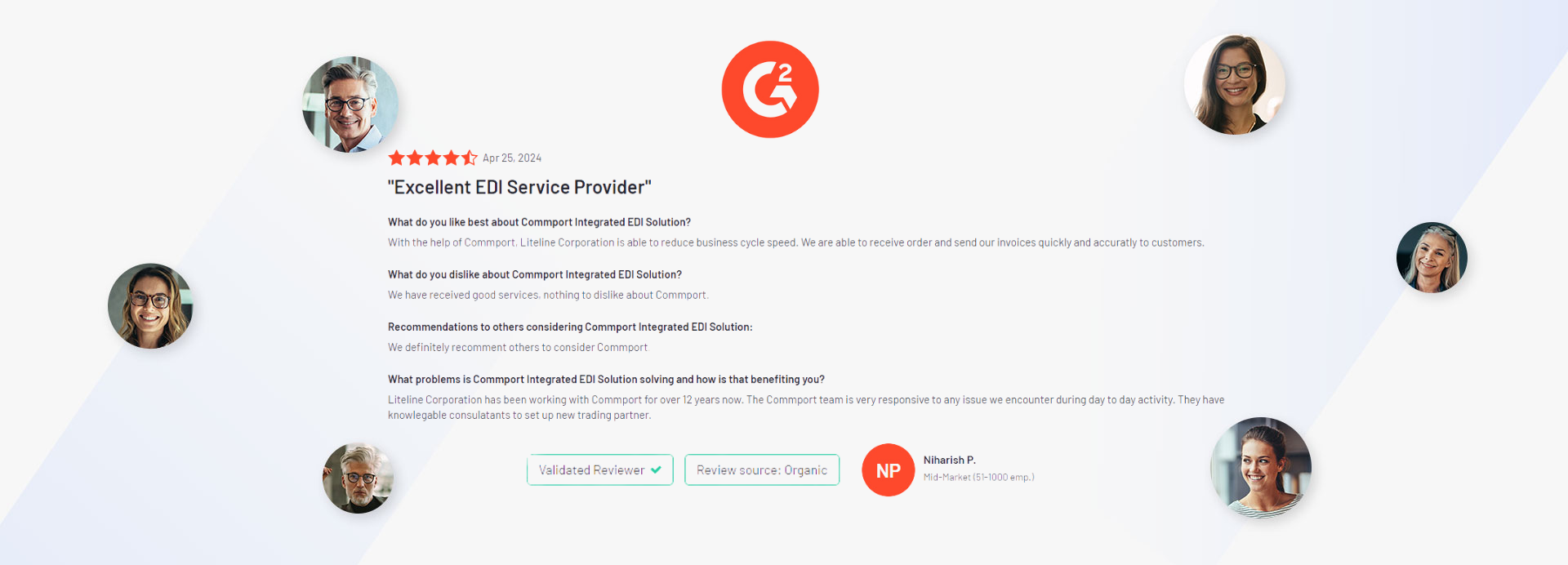

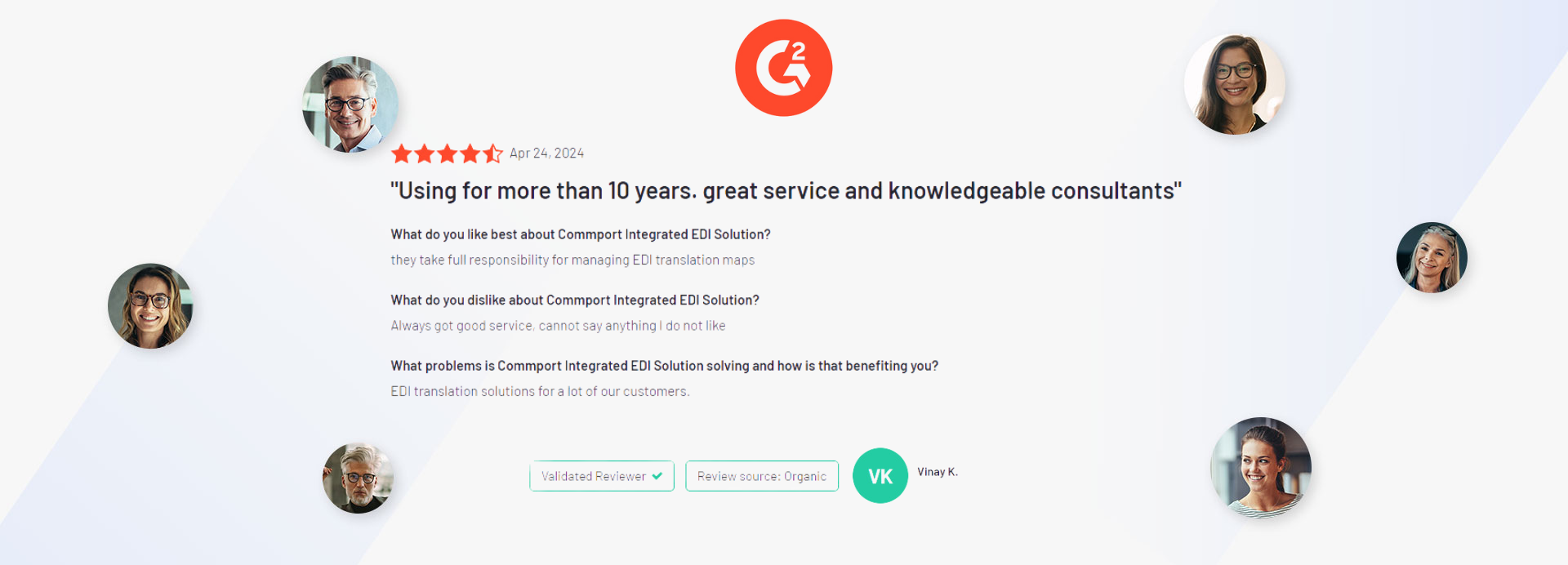

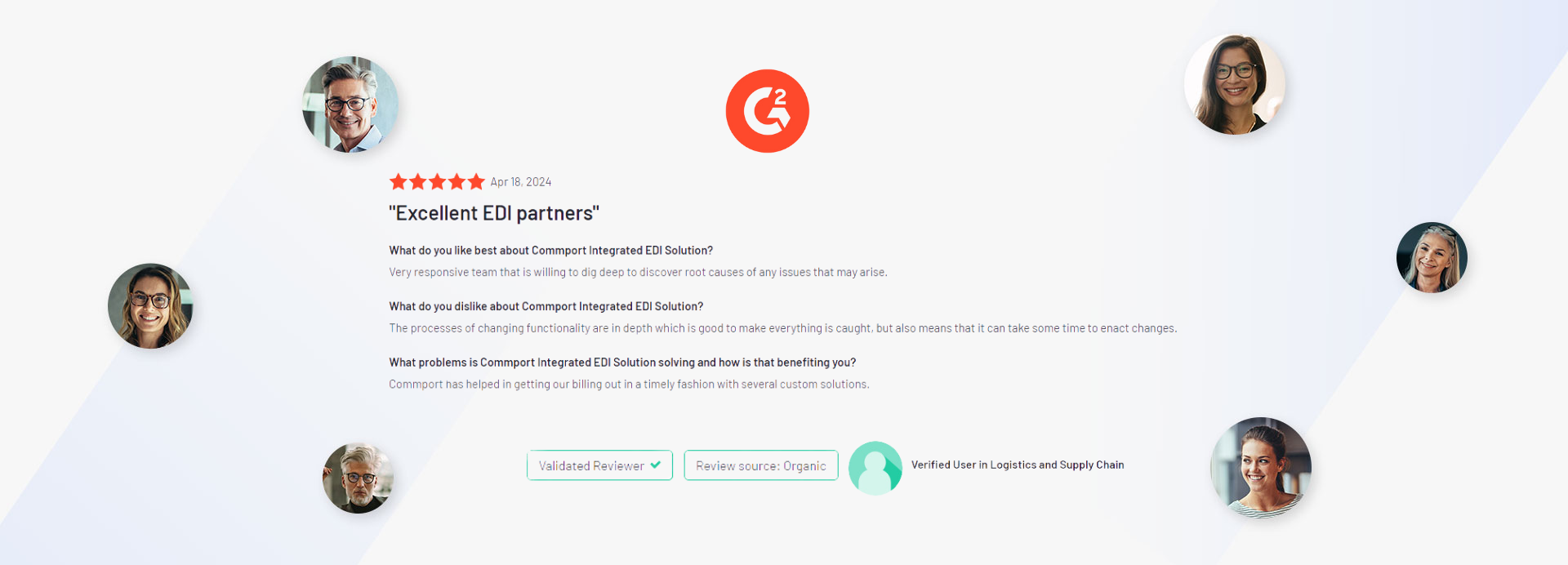

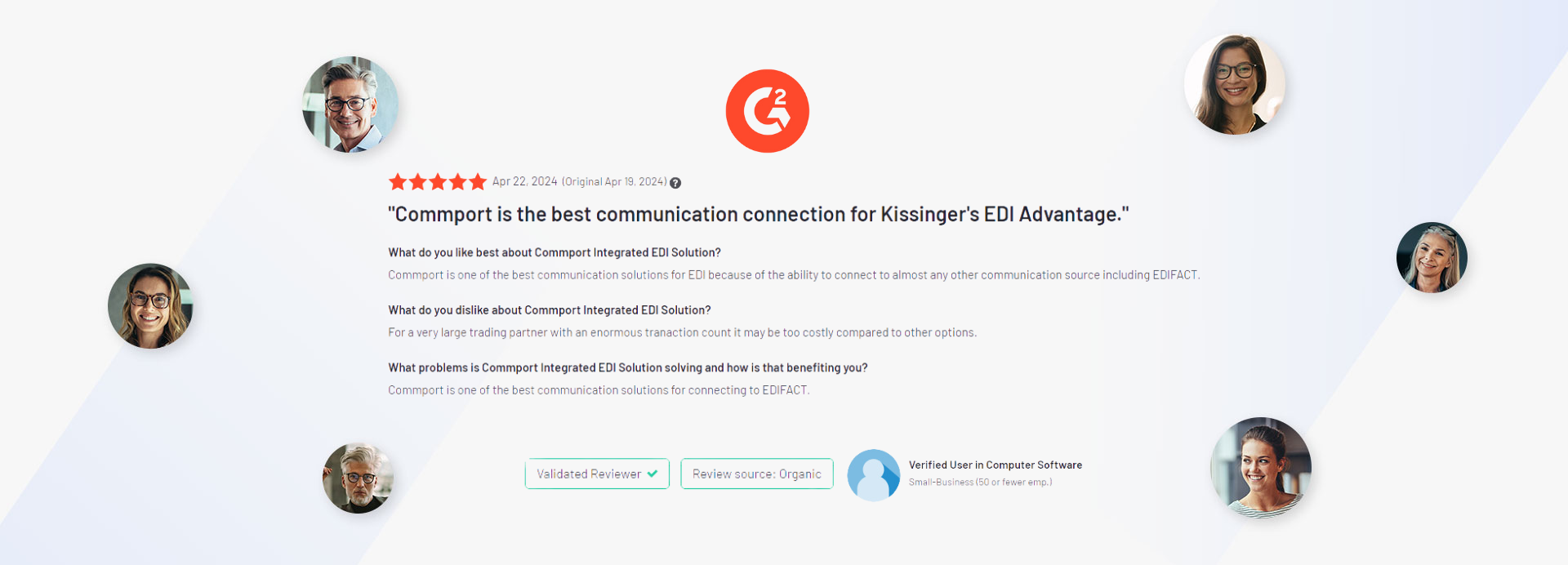

Discover the transformative impact of our EDI, CPS, and VAN solutions through the powerful testimonials of satisfied clients who have experienced remarkable results with Commport products and services.

We got the goods to help you utilize your EDI services effectively. We encourage you to explore our available resources below

Unlock the full potential of your supply chain with our comprehensive EDI Buyer's Guide — your first step towards seamless, efficient, and error-free transactions