Introduction

Bonded warehouses serve as specialized storage sanctuaries in the global supply chain.

The global bonded warehouse market is projected to reach $273.6 billion by 2031, yet many businesses still wonder, “What is a bonded warehouse?” and how it can benefit their operations.

With international trade growing by 3.5% from the previous year, we’re seeing an increasing number of companies seeking smart storage solutions to help them manage costs and improve cash flow.

Businesses using customs-bonded warehouses report tax cost savings of 25-30% through deferred duties and VAT payments.

Additionally, these specialized storage facilities offer flexibility for storing goods for up to five years, strategic locations near major ports, and value-added services like assembly and testing.

Whether you’re a small business breaking into international markets or an enterprise looking to streamline global distribution, understanding bonded storage could be the key to unlocking significant savings and operational efficiency.

What is a Bonded Warehouse? Understanding the Basics

Definition and core purpose

A bonded warehouse is a secured storage facility where imported goods can be stored without immediate payment of customs duties and taxes for up to five years from the date of importation.

Essentially, these buildings function as duty-free zones for imported or restricted goods waiting to continue their journey either into the domestic market or to international destinations.

The core purpose of a bonded warehouse revolves around financial flexibility. When goods enter a bonded warehouse, they’re technically considered still in transit to their destination. This creates a significant advantage: you maintain control over your capital until you decide to either pay duties (when withdrawing goods for domestic consumption) or avoid them altogether (when re-exporting).

Moreover, bonded warehouses allow for certain manipulations of stored goods. While in storage, items can undergo cleaning, sorting, repacking, or other alterations that don’t constitute manufacturing operations. This enables businesses to prepare products for their eventual market without triggering duty payments.

What Are Bonded Goods?

Bonded goods refer to imported products that are being stored under customs control, with taxes, duties, and other import fees still unpaid. These goods remain in a bonded status until all necessary customs documentation is completed and the applicable charges are settled. Once that happens, the goods are officially cleared and no longer considered bonded.

You’ll often find a variety of high-value or regulated products stored in customs-bonded warehouses, including:

- Fine wines and spirits

- Premium chocolates

- Cigars and other tobacco items

- Rare collectibles and antiques

- Original artwork

- Specialty coffees

- Designer handbags

- High-end perfumes and cosmetics

- Consumer electronics

- Luxury timepieces

- Fashion apparel and accessories

The main advantage for importers using bonded warehouses is the ability to defer payment of customs duties until the goods are sold or distributed within the country. This approach supports better cash flow management by postponing upfront import costs until revenue is generated.

How Bonded Storage Differs from Regular Warehousing

The fundamental difference between bonded and non-bonded warehouses lies in customs supervision and duty payment timing. In a bonded facility, imports and exports remain under strict government oversight, with taxes and duties deferred until goods leave the warehouse. Conversely, non-bonded warehouses operate without customs control, requiring immediate duty payment upon importing goods.

Another key distinction involves liability. Upon entry of goods into a bonded warehouse, both the importer and warehouse proprietor incur liability under a warehouse bond. This liability generally terminates when goods are:

- Exported or deemed exported

- Withdrawn for domestic consumption after duty payment

- Supplied to vessels/aircraft in international traffic

- Destroyed under customs supervision

Furthermore, bonded warehouses typically offer specialized services beyond basic storage. These include deep freeze capabilities, bulk liquid storage, commodity processing, and transportation coordination. Non-bonded facilities primarily focus on domestic distribution and retail operations.

Key Players in the Bonded Warehouse Ecosystem

The bonded warehouse ecosystem involves several essential stakeholders working together under regulatory frameworks. The primary players include:

- Warehouse Proprietors: These can be private businesses or government entities that own and operate the physical facilities. They bear responsibility to both the goods’ owners and customs authorities. Private bonded warehouses are projected to hold the largest market share in the coming years.

- Customs Authorities: Government agencies like the U.S. Customs and Border Protection (CBP) authorize and regulate bonded warehouses. They establish the legal framework, conduct inspections, and ensure compliance with regulations outlined in statutes like Title 19, United States Code, section 1555.

- Importers and Exporters: Businesses that own the goods stored in bonded warehouses. They benefit from deferred duties and supply chain flexibility. From manufacturers to retailers, various industries utilize these facilities for pharmaceuticals, electronics, automotive parts, and more.

- Logistics Service Providers: Companies that facilitate the movement of goods to and from bonded warehouses often provide additional value-added services throughout the process.

Together, these stakeholders form an interconnected system that supports global trade while maintaining regulatory compliance. Understanding how each player contributes to the ecosystem helps businesses maximize the benefits of bonded warehousing.

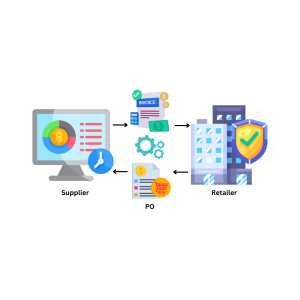

How Bonded Warehouse Work?

At its core, a bonded warehouse provides secure storage for imported goods that are subject to duties and customs regulations. These facilities hold shipments until all necessary taxes are paid and customs documentation is completed. The process of using a bonded warehouse is straightforward and typically follows these four key steps:

- Importing Goods

Before utilizing a bonded warehouse, you must obtain authorization from Customs and Border Protection (CBP) to import restricted or duty-deferred goods. Once approved, your shipment is delivered directly to the bonded warehouse, where the facility’s personnel take control of the inventory under customs supervision.

- Storing Shipments

The bonded warehouse ensures your goods are securely stored and properly monitored. Many offer specialized storage capabilities—such as climate-controlled or refrigerated units—to accommodate sensitive items.

Throughout the storage period, the facility maintains detailed documentation and tracking of your inventory according to the terms of the import agreement. Goods can typically remain in storage for up to five years, depending on local regulations.

- Forwarding Goods

When you’re ready to move the goods, the warehouse prepares them for release. Before handing them over to your chosen carrier, the bonded warehouse confirms that all duties and taxes have been paid and that customs clearance requirements are met. From there, the goods are forwarded to their next destination, either domestically or internationally.

- Making Payment

Once the goods are released, the bonded warehouse issues a detailed invoice outlining all applicable charges, including storage fees, taxes, and customs duties. Payment is required at this stage.

For businesses using modern warehouse management systems that support Electronic Data Interchange (EDI), invoices can be sent electronically accelerating billing and payment workflows.

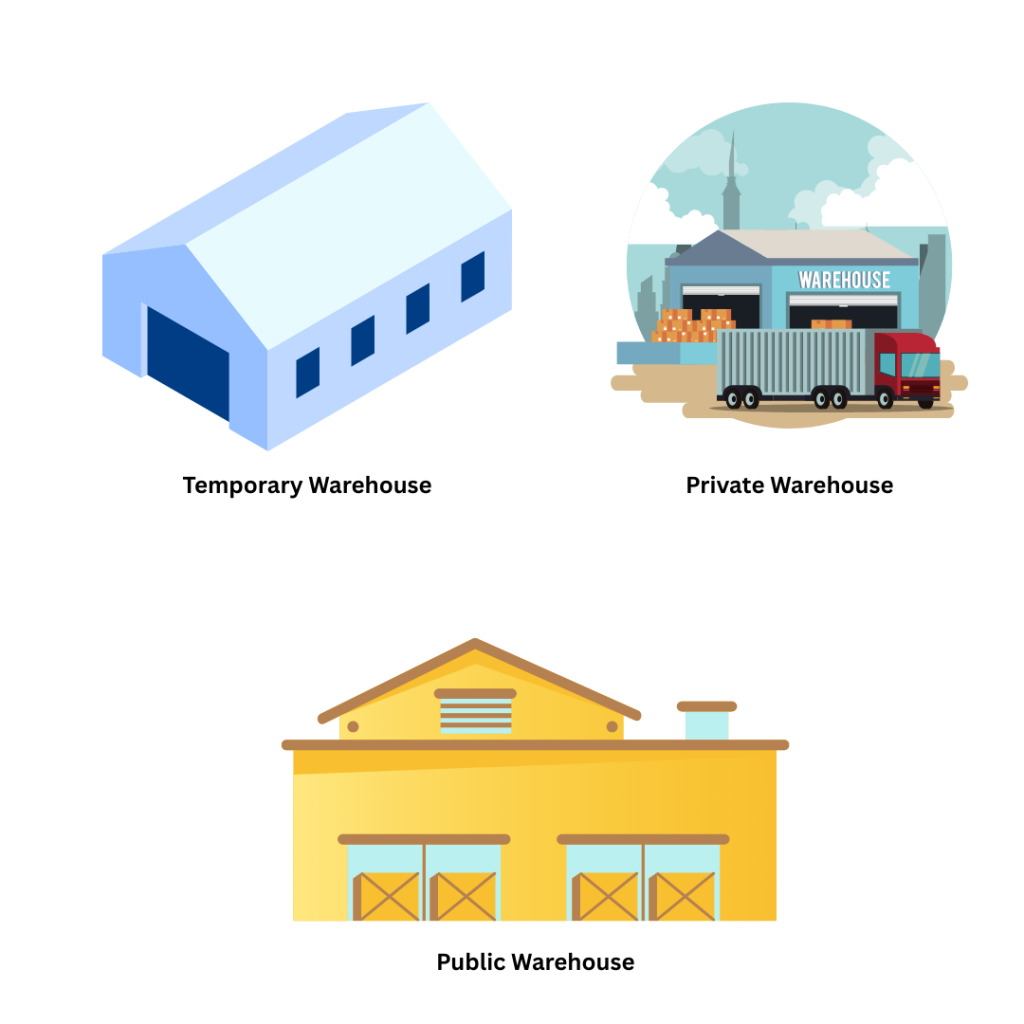

Different Types of Bonded Warehouse

Bonded warehouses come in various forms, each designed to meet specific regulatory and logistical needs. Understanding the different types helps businesses choose the right storage option for their imported goods. Here are the main categories:

- Public Bonded Warehouse

These are operated by third-party logistics providers and are available for use by multiple businesses. Public bonded warehouses are ideal for importers who don’t have storage facilities and prefer a flexible, pay-as-you-go model. They’re commonly used by small to medium-sized enterprises that import in moderate quantities.

Best for: Businesses that want short- or long-term storage without owning or leasing a private facility.

- Private Bonded Warehouse

Owned and operated by a single company, private bonded warehouses are used exclusively by that organization. These are typically set up by large importers or manufacturers who have high-volume or specialized storage needs. The facility must still meet customs requirements and be approved for bonded status.

Best for: High-volume importers with consistent storage and supply chain requirements.

- Government Bonded Warehouse

Operated by a government agency, these warehouses are often used to store seized or confiscated goods, restricted items, or imports pending legal clearance. Businesses typically don’t use these unless specifically directed by authorities.

Best for: Government-related storage needs or goods under legal scrutiny.

- Temporary Bonded Warehouse

These facilities are used for short-term storage of goods in transit or awaiting quick distribution. They’re ideal for importers who need brief customs clearance periods or plan to move products within days or weeks.

Best for: Time-sensitive goods that require temporary customs-controlled storage.

- Special Economic Zone (SEZ) Warehouses

Located within designated trade zones, SEZ bonded warehouses allow businesses to import, store, and process goods with minimal customs interference. Duties are deferred or waived entirely if goods are re-exported.

Best for: Exporters, manufacturers, or companies engaged in international trade processing.

- Free Trade Zone (FTZ) Warehouses

These are similar to SEZs but are specifically designated by governments to encourage trade by offering duty exemptions, relaxed regulations, and streamlined customs procedures. Goods can be stored, assembled, repackaged, or modified before entering the local market or being shipped abroad.

Best for: Businesses looking to lower costs and simplify cross-border trade processes.

The Financial Advantages of Bonded Warehousing

Beyond the operational benefits, the true power of bonded warehousing lies in its financial advantages. For businesses navigating international trade, these specialized facilities offer remarkable opportunities to optimize taxes and manage cash flow.

1. Deferring import duties and taxes

One of the most significant financial perks of bonded warehousing is the ability to postpone customs duties and taxes. Rather than paying these fees upon arrival, businesses can defer payment until goods leave the warehouse for domestic consumption. This postponement can last up to five years, giving importers extraordinary flexibility with their capital.

Consider this practical benefit: when importing high-value or large-quantity shipments, immediate duty payments can create substantial financial pressure. A bonded warehouse effectively removes this constraint, allowing you to bring products into the country without immediately tying up funds in tax obligations.

Consequently, this deferral mechanism helps businesses align duty payments with their actual sales cycle. I pay only when I’m ready to sell, not when my goods arrive at the port.

2. Eliminating double taxation on re-exports

Perhaps the most compelling advantage emerges when goods are ultimately re-exported rather than sold domestically. In this scenario, no import duties need to be paid at all. The ability to avoid these duties completely can result in tax savings of approximately 25-30% for businesses utilizing bonded warehouses.

This elimination of double taxation is particularly valuable for companies engaged in international distribution. Without bonded warehousing, products moving through multiple countries would face repeated taxation, dramatically increasing costs. By storing goods in bonded facilities, I can prevent this costly duplication of fees.

3. Cash flow improvements for growing businesses

The financial breathing room provided by bonded warehouses directly translates to improved cash flow. Rather than allocating substantial funds to upfront duties and taxes, businesses can redirect that capital toward growth initiatives.

This cash flow advantage becomes especially crucial for:

- Expanding operations or facilities

- Increasing inventory to meet growing demand

- Investing in new market opportunities

- Covering operational expenses during seasonal fluctuations

For growing businesses with limited capital, the ability to postpone duty payments can mean the difference between struggling with liquidity issues and having sufficient funds for strategic investments. As one customs expert noted, these warehouses enable companies to “allocate their financial resources more efficiently”.

4. Hidden tax benefits most businesses overlook

Beyond the obvious advantages, bonded warehouses offer several lesser-known tax benefits that many importers fail to leverage. Notably, certain bonded warehouse classifications permit value-added activities like assembly, testing, and packing before tax assessment.

This pre-tax manipulation can significantly reduce overall import costs, particularly when raw materials face higher tax rates than finished goods. Through strategic planning, businesses can legally structure their operations to minimize tax obligations while maintaining full compliance.

Additionally, bonded warehouses provide an ideal environment for manufacturing goods specifically destined for export. This arrangement eliminates the need to pay import duties on materials that will ultimately be shipped internationally.

The strategic timing of customs clearance represents another overlooked benefit. Businesses can bring goods into free circulation when market conditions are most favorable – for instance when local prices increase due to supply or demand shifts. Meanwhile, the ability to order larger quantities when exchange rates are advantageous creates further cost efficiencies that directly impact the bottom line.

Through careful planning and proper utilization of bonded warehouse benefits, importers can preserve their profit margins while ensuring complete regulatory compliance.

Strategic Supply Chain Benefits Beyond Cost Savings

Looking beyond pure cost savings, bonded warehouses offer game-changing supply chain advantages. These strategic benefits help businesses operate more efficiently in global markets while adapting to changing conditions.

1. Positioning inventory closer to global markets

Bonded warehouses are typically located near major ports and transportation hubs. This strategic positioning creates a significant competitive edge by reducing lead times and transportation costs across your entire supply chain.

Indeed, many customs-bonded warehouses serve as ideal distribution centers, positioned to quickly move products to various international markets. This proximity to ports allows businesses to export goods rapidly when market conditions become favorable.

Subsequently, this strategic positioning helps reduce not only costs but also carbon emissions—making bonded storage an environmentally responsible choice as well. For companies serving multiple international markets, this centralized approach simplifies cross-border trade complexities through streamlined customs processes.

2. Flexibility during market fluctuations

One of the most valuable aspects of bonded warehousing is the ability to respond to changing market dynamics. Bonded facilities offer extended storage periods, allowing businesses to hold inventory until market conditions become favorable for their products.

This flexibility is particularly beneficial for:

- Seasonal products requiring storage until peak demand periods

- Perishable goods like seafood and fresh produce

- Products awaiting quota resets or tariff rate decreases

- Inventory management during unpredictable market volatility

Above all, this adaptability prevents businesses from being forced to sell at a loss just to balance inventory levels. Companies can accordingly build up or reduce inventory based on anticipated customer demand.

3. Quality control opportunities before duty payment

Equally important, bonded warehouses provide valuable quality assurance opportunities before goods enter the domestic market. Businesses can inspect and test products stored in these facilities to ensure they meet the quality standards expected by customers.

The controlled environments available in many bonded warehouses help maintain product quality, especially for items sensitive to temperature, humidity, or other environmental factors. This preservation capability ensures goods remain in optimal condition during storage, maintaining both quality and market value.

What makes a bonded warehouse particularly valuable for quality control is the ability to perform these inspections before paying import duties. Should products fail to meet standards, they can be re-exported without incurring tax obligations—a significant risk mitigation advantage for importers dealing with new suppliers or unfamiliar products.

Likewise, many facilities offer value-added services like packaging, labeling, order processing, and shipping, creating a comprehensive solution that streamlines operations while maintaining strict quality oversight.

Streamline Bonded Warehouse Management with Commport EDI Solutions

Efficient warehouse management is critical to maintaining a responsive and cost-effective supply chain. From inventory tracking and order processing to customs clearance and logistics coordination, businesses need systems that ensure speed, accuracy, and visibility across all operations. This is where Commport Communications steps in—offering seamless integration of warehousing processes through advanced Electronic Data Interchange (EDI) technology.

Commport EDI Solutions enables real-time data exchange between warehouses, suppliers, carriers, and trading partners. By automating order confirmations, shipping notices, inventory updates, and customs documentation, Commport helps eliminate manual errors and delays. Whether you’re managing a bonded warehouse, public facility, or part of a larger distribution network, Commport’s EDI platform ensures your data flows securely and efficiently across all stakeholders.

With Commport EDI Solutions, businesses gain improved inventory accuracy, faster fulfillment times, and end-to-end supply chain visibility. Our scalable, cloud-based technology integrates easily with your existing warehouse management systems and third-party logistics providers—empowering you to streamline operations, reduce costs, and grow with confidence.

Conclusion

Bonded warehouses help businesses aiming to optimize their international trade operations. Through strategic use of these facilities, companies can save 25-30% on tax costs while maintaining complete control over their inventory timing and movement.

Many successful businesses prove that bonded warehousing delivers more than just financial benefits. Smart positioning near major ports reduces delivery times, while quality control opportunities help maintain product standards before paying duties. These advantages become especially valuable during market fluctuations, allowing businesses to adapt their storage and distribution strategies.

Businesses ready to enhance their warehousing operations should consider Commport EDI Solutions for the Warehousing Industry, which streamlines documentation and inventory management processes. Though selecting the right bonded warehouse requires careful evaluation of location, technology capabilities, and service offerings, the potential rewards make this investment worthwhile.

Remember that bonded warehouses serve as more than storage spaces – they act as strategic assets that can transform your international trade operations. Whether you run a small business breaking into global markets or manage enterprise-level distribution, these facilities offer the flexibility and efficiency needed for success in today’s competitive landscape.

Commport EDI Solutions for Warehousing Industry

Need Help? Download: EDI Buyers Guide

Unlock the full potential of your supply chain with our comprehensive EDI Buyer's Guide — your first step towards seamless, efficient, and error-free transactions

Frequently Asked Questions

Bonded warehouses offer several advantages, including deferring import duties and taxes, eliminating double taxation on re-exports, improving cash flow for businesses, and providing strategic supply chain benefits such as positioning inventory closer to global markets.

Bonded warehouses are used by various entities involved in international trade, including importers, exporters, manufacturers, and distributors. They are particularly beneficial for businesses dealing with high-value goods, seasonal products, or those engaged in re-export activities.

Goods can be stored in a bonded warehouse for up to five years from the date of importation. This extended storage period allows businesses to align their inventory with market demand and avoid immediate duty payments.

While in a bonded warehouse, goods can undergo certain manipulations such as cleaning, sorting, repacking, and quality control inspections. Some facilities also offer value-added services like assembly, testing, and packaging, all without triggering duty payments.

When selecting a bonded warehouse, consider factors such as location and accessibility, technology integration capabilities, compliance with customs regulations, and available services. Look for facilities near major ports or transportation hubs, with advanced inventory tracking systems, and those offering services that align with your specific business needs.